How a Cash Balance Plan Calculator Can Maximize Your Retirement Savings?

What is a Cash Balance Plan?

These plans are particularly beneficial for business owners and high-income earners who seek:

-

Higher tax-deductible contributions compared to 401(k) and IRA limits

-

A predictable growth rate for their retirement funds

-

The ability to maximize retirement savings in a short period

To understand the full potential of these plans, using a cash balance plan calculator is essential.

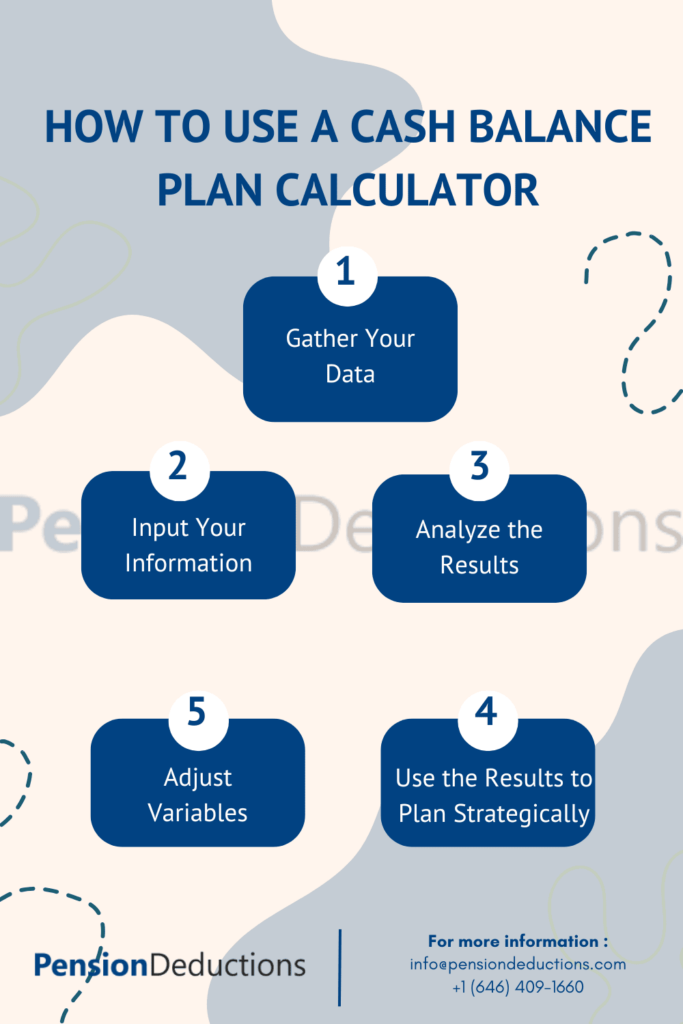

How a Cash Balance Plan Calculator Works?

-

Annual Income

Higher earners can contribute significantly more than in traditional plans

-

Age

Older participants can make larger contributions due to catch-up provisions

-

Years Until Retirement

Determines the total possible accumulation

-

Business Structure

Sole proprietors, partnerships, and corporations have different contribution limits

Calculate Your Contirbution Now!

Model Title

“A defined benefit plan requires the assumption of a retirement age which is normally 62 or 65. Since you have already reached this age we will need to perform further actuarial adjustments in order to calculate your defined benefit contribution. Unfortunately, this cannot be done online. Please get in touch with our office and we will come up with a projection for you. You can reach us at info@pensiondeductions.com or get in touch with us here.”

Let’s TalkMaximizing Retirement Savings with a Cash Balance Plan

-

1

Optimize Contributions Based on Income

-

2

Combine with a 401(k) Plan

-

3

Take Advantage of Catch-Up Contributions

-

4

Reduce Tax Liabilities

Who Should Use a Cash Balance Plan Calculator?

Small Business Owners

High-income Professionals

Partnerships and Corporations

Late-career Professionals

Common Mistakes to Avoid When Using a Cash Balance Plan Calculator

-

Misinterpreting Results

Ensure you understand contribution limits and distribution rules.

-

Ignoring Plan Compliance

Contribution limits and rules change yearly, so staying updated is crucial.

-

Not Consulting a Financial Advisor

A Cash Balance Plan Calculator provides estimates, but a professional can help optimize your plan.

-

Failing to Re-evaluate Annually

Your income and financial goals may change, requiring updates to your plan.

Best Cash Balance Plan Calculators Available in 2025

Pension Deductions’ Cash Balance Plan Calculator

Bankrate Retirement Calculator

Fidelity Cash Balance Plan Estimator

Vanguard Retirement Plan Analyzer

Conclusion

If you’re looking for a Cash Balance Plan Calculator that offers detailed insights tailored to your income and business structure, try Pension Deductions’ cash balance plan calculator today. Plan smarter, save more, and secure your financial future with confidence.

SHARE THIS POST

Discover the top 10 retirement trends 2026—from Roth adoption and AI planning tools to SECURE Act updates and cash balance plans.

Discover how EE and ER pension plans are making a comeback in 2025 and what this means for employers and employees seeking better retirement security.

Under SECURE Act rules, you can still set up retirement plans for last year’s taxes. Learn deadlines, benefits, and tax savings.

Learn everything about pension deductions in 2025—rules, limits, and strategies to maximize retirement tax savings for business owners.