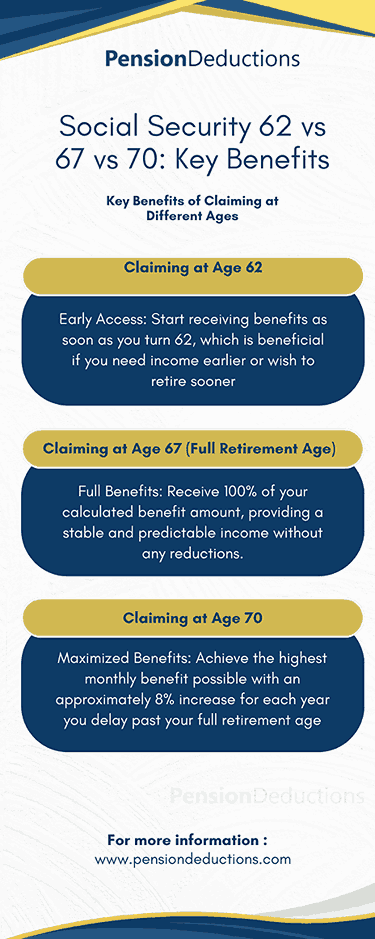

Social Security 62 vs 67 vs 70

When it comes to planning for retirement, one of the most critical decisions you’ll make is when to start taking Social Security benefits. The choice between beginning your benefits at age 62, 67, or 70 can significantly impact your financial future. This guide delves into the nuances of each option, providing you with the latest information to help you make an informed decision about Social Security 62 vs 67 vs 70.

Understanding Social Security Benefits

Social Security benefits are designed to provide financial support during retirement, but the amount you receive depends heavily on when you choose to start claiming them. The full retirement age (FRA) for Social Security is typically between 66 and 67, depending on your birth year. However, you can start claiming benefits as early as 62 or as late as 70. This decision of Social Security 62 vs 67 vs 70 will affect your monthly benefit amount.

Social Security at Age 62

Choosing to start Social Security benefits at age 62 can be tempting, especially if you’re eager to begin enjoying your retirement. However, there are important considerations in the Social Security 62 vs 67 vs 70 debate.

Pros

-

Early Access You can begin receiving benefits as soon as you turn 62, which might be appealing if you plan to retire early or need income sooner rather than later.

-

Flexibility Starting early provides more flexibility in how you manage your retirement assets.

Cons

-

Reduced Benefits Starting at 62 means your monthly benefit will be permanently reduced. For each year you claim before your full retirement age, your benefits decrease by approximately 6.7% for the first three years and 5% for each additional year. This reduction is a key consideration in the Social Security 62 vs 67 vs 70 decision

-

Longevity Risks If you live a longer life, the reduction in benefits might result in less total income over your lifetime compared to waiting until your full retirement age or 70

Know More!

Schedule a Free Consultation Now!

Social Security at Age 67

Claiming Social Security benefits at your full retirement age (FRA) of 67 allows you to receive your full benefit amount. This age is considered the standard for many, balancing the trade-offs between starting benefits early and waiting for a higher amount in the Social Security 62 vs 67 vs 70 comparison.

Pros

-

Full Benefits At age 67, you receive 100% of your calculated benefit amount, without any reductions

-

Balanced Approach This age offers a compromise between starting early and waiting longer, providing a stable and predictable benefit level

Cons

-

Delayed Access: If you need or want benefits before this age, you won't have access to them until you reach 67

-

Missed Opportunity for Higher Benefits: By not waiting until age 70, you miss out on the opportunity to receive higher monthly benefits

Social Security at Age 70

Waiting until age 70 to start receiving Social Security benefits offers the highest monthly payment possible. This option is ideal for those who can afford to delay their benefits and wish to maximize their monthly income in the Social Security 62 vs 67 vs 70 decision-making process.

Pros

-

Increased Benefits: Delaying benefits until age 70 results in an approximately 8% increase in your monthly benefit for each year you wait past your full retirement age. This can significantly boost your income if you live into your late 70s or beyond

-

Higher Lifetime Benefits: If you anticipate living a long life, waiting until age 70 can result in a greater total benefit over your lifetime

Cons

-

Delayed Access: You will need to wait longer to start receiving benefits, which might be challenging if you need income sooner or have health concerns

-

Opportunity Cost: If you need to use other retirement savings or income sources while waiting, you might face an opportunity cost

Key Considerations

-

Longevity: Your life expectancy plays a crucial role in deciding when to start benefits. If you have a family history of longevity or are in good health, waiting until age 70 might be more beneficial in the Social Security 62 vs 67 vs 70 context

-

Financial Needs: Assess your current financial situation and retirement goals. If you need income sooner or plan to retire early, starting at 62 might be more practical

-

Spousal Benefits: If you are married, consider how your claiming decision will affect your spouse's benefits. Coordinating your claiming strategy can optimize your combined benefits

-

Employment: If you plan to continue working past age 62, be aware that your benefits may be temporarily reduced if you earn above a certain threshold before reaching your full retirement age

Final Thoughts

Deciding when to start Social Security benefits is a personal choice that depends on your individual circumstances. Whether you opt for Social Security at 62, 67, or 70, each option has its own set of benefits and trade-offs. By understanding the implications of each choice, you can make a decision that aligns with your financial goals and retirement plans.

For more detailed information and personalized advice, consider consulting with a financial advisor who can help you navigate the complexities of Social Security and develop a strategy tailored to your needs. Remember, the key to successful retirement planning is making informed decisions based on your unique situation.

By considering Social Security 62 vs 67 vs 70, you can make the best choice for your retirement and ensure a more secure financial future.

For more detailed information and personalized advice, consider consulting with a financial advisor who can help you navigate the complexities of Social Security and develop a strategy tailored to your needs. Remember, the key to successful retirement planning is making informed decisions based on your unique situation.

By considering Social Security 62 vs 67 vs 70, you can make the best choice for your retirement and ensure a more secure financial future.

SHARE THIS POST

Related Blogs

Increase in Social Security Benefits, April 2025

Read More »

Millions of retirees will see increased Social Security Benefits in April 2025 due to WEP and GPO eliminations—learn how it impacts you!

Shrideep Murthy

April 1, 2025

9:15 pm

Social Security Reforms 2024

Read More »

Uncover how Social Security Reforms 2024 will impact retirees with crucial changes to taxes, benefits, and retirement age adjustments.

Shrideep Murthy

November 27, 2024

9:15 pm

Top 6 Retirement Savings Tips for 55 to 64 Year Olds

Read More »

Discover the top retirement savings tips for individuals aged 55 to 64. Learn how to maximize your 401(k), IRAs, Social Security, and pension benefits while planning for a secure future.

Shrideep Murthy

October 25, 2024

9:15 pm

Social Security 62 vs 67 vs 70: The Ultimate Guide

Read More »

Explore the best age to claim Social Security benefits 62 vs 67 vs 70 with our comprehensive guide on maximizing your retirement income.

Shrideep Murthy

September 19, 2024

9:15 pm