IRS Contribution Limits 2025

This blog explores the nuances of the IRS Contribution Limits 2025, their implications, and how you can take advantage of these changes.

Why Contribution Limits Matter?

Tax Savings

Contributions to traditional accounts lower taxable income.

Retirement Growth

Higher limits mean more savings and compounding returns over time.

Employer Benefits

Employer matching contributions often depend on employee contributions, making limits a key factor.

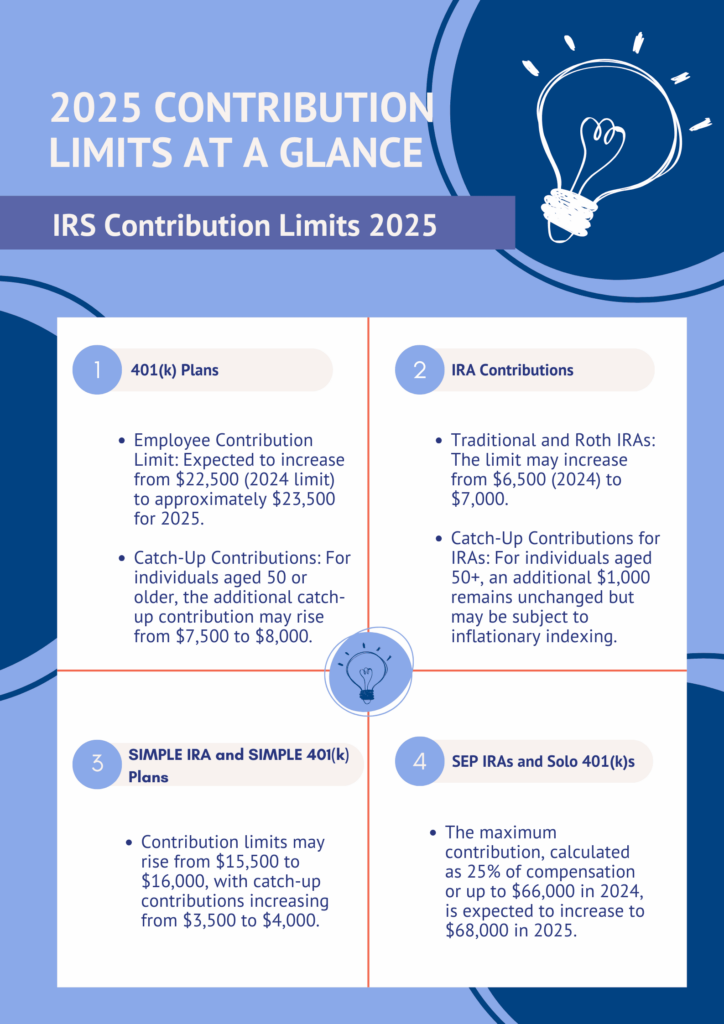

IRS Contribution Limits 2025 at a Glance

The IRS adjusts these limits annually based on inflation and other factors. While the exact figures for the IRS Contribution Limits 2025 may still be subject to minor revisions, here’s what we know based on recent trends:

401(k) Plans

- Employee Contribution Limit: Expected to increase from $22,500 (2024 limit) to approximately $23,500 for 2025

- Catch-Up Contributions: For individuals aged 50 or older, the additional catch-up contribution may rise from $7,500 to $8,000

IRA Contributions

- Traditional and Roth IRAs: The limit may increase from $6,500 (2024) to $7,000

- Catch-Up Contributions for IRAs: For individuals aged 50+, an additional $1,000 remains unchanged but may be subject to inflationary indexing

SIMPLE IRA and SIMPLE 401(k) Plans

- Contribution limits may rise from $15,500 to $16,000, with catch-up contributions increasing from $3,500 to $4,000

SEP IRAs and Solo 401(k)s

- The maximum contribution, calculated as 25% of compensation or up to $66,000 in 2024, is expected to increase to $68,000 in 2025

Changes Impacting Employers and High Earners

Overall Contribution Caps:

The combined employer and employee contributions for 401(k) plans will likely increase from $66,000 to $68,000, reflecting a rise in the annual compensation limit from $330,000 to $340,000.

Highly Compensated Employees (HCE):

The threshold for HCE status, currently $150,000, may rise to $155,000 or higher, impacting compliance tests for retirement plans.

Schedule a Free Consultation Now!

How These Changes Address Inflation?

Tips for Maximizing Contributions in 2025

- Start Early: Contribute as much as possible at the start of the year to maximize compound growth.

- Automate Contributions: Set up automatic deductions to ensure consistent savings.

- Utilize Catch-Up Contributions: If you're 50 or older, take advantage of higher limits

- Reassess Your Budget: Align your retirement savings goals with the new IRS Contribution Limits 2025.

FAQs

The Bigger Picture

SHARE THIS POST

Discover the top 10 retirement trends 2026—from Roth adoption and AI planning tools to SECURE Act updates and cash balance plans.

Discover how EE and ER pension plans are making a comeback in 2025 and what this means for employers and employees seeking better retirement security.

Under SECURE Act rules, you can still set up retirement plans for last year’s taxes. Learn deadlines, benefits, and tax savings.

Learn everything about pension deductions in 2025—rules, limits, and strategies to maximize retirement tax savings for business owners.