One of the best-kept secrets of the pension industry is a type of pension plan that provides much larger contributions to the business owners than a SEP-IRA.

If you have employees, please scroll below to the section titled, Small Business with Employees. If you do not have employees, please keep reading:

The pension plan with the potential to generate contributions larger than a SEP-IRA is a defined benefit plan.

There are a lot of myths surrounding a defined benefit plan, many of which are just myths. Since you are self-employed, the defined benefit plan works very similar to a SEP-IRA, except that the contribution limit is higher.

If we have your attention till here, you are in for some serious tax savings!

A defined benefit plan is capable of generating a tax deduction of up to $200,000 and higher in some scenarios, making it an ideal choice for a self employed individual looking for a large tax deduction.

If you want to get an estimate of what you can contribute to a defined benefit plan, please use our defined benefit calculator on the right.

Defined benefit plan example

Case Study: A Retirement Plan for self employed individual

Client 1

Employment status: Self employed

Three year average income: 100,000 as W-2 compensation/Schedule C income/K-1 Income

Participant’s age: 50

A participant with the above mentioned parameters can accumulate $ 1,248,535.08 till s/he reaches an assumed retirement age of 62. In the first year, a maximum contribution of $ 82,788.00 can be made to the defined benefit plan.

Client 2

Employment status: Self employed

Three year average income: More than $265,000 as W-2 compensation/Schedule C income/K-1 Income

Participant’s age: 50

A participant with the above-mentioned parameters can accumulate $ 2,621,923.68 till s/he reaches an assumed retirement age of 62. In the first year, a maximum contribution of $ 166,267.00 can be made to the plan.

You can use our online defined benefit calculator to find out how much you can contribute to a defined benefit plan.

Small Business with Employees:

If you are a small business with employees, the IRS requires you to contribute to them if they have:

- attained age 21;

- worked for your business in at least 3 of the last 5 years;

- received at least $600 in compensation (in 2016 – 2018) from your business for the year.

It takes a very generous person to set up a SEP-IRA if you have eligible employees.

For example, if you contribute 20% of your W-2 wages to your SEP-IRA, you have to contribute 20% of the employee’s W-2 wages as a contribution to their SEP-IRA accounts. This 20% has to be an entirely employer contribution and you cannot withhold any portion of it from the employee wages.

There are two ways in which this situation can be turned in your favor:

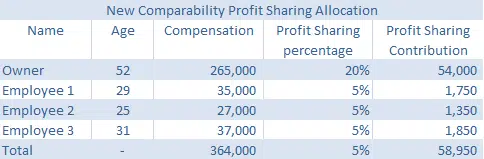

Option 1: You can limit contribution to employees at 5% of their W-2 compensation while you contribute the maximum of $54,000 in a profit sharing plan. This design is called as a New-Comparability profit sharing plan. Please read more about it below.

Option 2: You can contribute more than $54,000 for yourself by setting up a defined benefit plan while contributing between 5% to 7.5% of employee wages in a profit sharing plan set up for the employees. This design is called as a floor offset defined benefit plan design. Please scroll down to read more about it.

Option 1: New Comparability Profit Sharing Plan

A new comparability profit sharing plan is an IRS approved pension plan design which allows skewing of benefits in favor of owners and key employees within certain limits. A third party administrator like we will perform Non-discrimination testing in order to ensure compliance with all IRS rules. Of course, such a plan design will incur administrative costs, but the savings on employee contributions will be much larger making the administrative costs look insignificant.

A typical new comparability allocation will look as below:

Floor offset defined benefit plan design

A floor offset plan is one of the most advanced pension plan design and involves a defined benefit plan and a profit sharing plan working together.

Who is it ideal for?

The floor offset is ideal if:

- Your business has a lot of free cash flow and you are looking to put aside a large sum of money for your own retirement.

- You are a small to medium sized business (less than 10 employees)

- There is only a single owner of the business or at least a small number (2-3) partners.

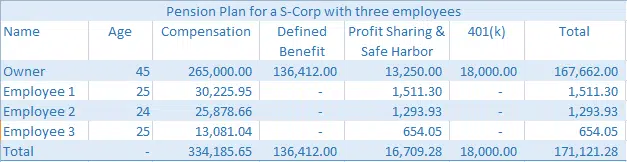

A typical floor offsets allocation:

So what exactly is this plan design?

Let’s set up the background first with the help of an example. Let’s assume you are the owner of a small business with five employees and have a decent amount of free cash flow. You just turned 50 this year and are appalled by the fact that in spite of a successful decade in business, you have managed to accumulate only $500,000 towards your retirement goals. You want higher contributions each year, while keeping the allocations to your employees low.

Someone just mentioned about a defined benefit plan to you. However, since you have employees, you will have to provide a retirement plan option for them as well. If you include your employees in the defined benefit plan, you end up contributing a large amount of money to them, so large that it does not make sense to sponsor a retirement plan.

This is where a floor offset comes into rescue.

The IRS permits segmentation in a defined benefit plan, which basically means assigning different people to different classes based on job title, location etc. As the owner, you are a part of class 1, while all other non-owner employees are a part of class 2. The IRS also permits different allocation formulas for each class. The allocation formula is typically a certain percentage of compensation that will be earned in retirement. This formula determines how much money you can accumulate as the owner and how much money you have to contribute towards your employees.

As the owner, you can choose to receive 100% of your compensation, subject to a cap of $210,000 each year after retirement. You can also design the plan, such that employees receive 5% of their compensation as retirement benefits. This is the first step in reducing the costs. However, the floor offset goes one step further in this regards. A profit sharing plan is designed to work in accordance with the defined benefit plan. Everyone is allocated a minimum of 5% of pay in the profit sharing plan. These allocations in the profit sharing plan are then used to ‘offset’ the benefits the employees receive in the defined benefit plan. In most cases, the entire benefits of the employees of the defined benefit plan are offset and they receive only the 5% contribution in the profit sharing plan.

When we say ‘offset’, it does not mean we take the benefits in the defined benefit plan and subtract the allocation in the profit sharing plan. Complex financial mathematics is involved in this as everyone’s benefits are projected to an assumed retirement age of 62/65 and offset at that point.

There is also the added complexity of cross-testing of benefits and contributions. As your third party administrator, we will mask all this complexity and do the math for you. We use high end software and the expertise of actuaries to achieve the optimal allocations for our clients.

If you have employees who are older than you, then their benefits may not offset completely. Such employees will receive the allocation in the profit sharing plan and the residual benefits which were not offset from the defined benefit plan.

The floor offset plan is probably the only plan design that allows you to contribute a large amount of money for yourself while keeping employee contributions in the 5–7.5% range. Below is a real example of a floor offset plan in action. This was designed for one of our clients who is relatively young.

If your business entity is an S-Corp/C-Corp, compensation is defined as gross compensation reported on W-2. The IRS does not permit the use of K-1 income as an acceptable definition of compensation.

If your business entity is Sole-prop, determining compensation is a circular calculation and cannot be done online. You should reach out to your service provider or email us at info@pensiondeductions.com and we shall be happy to do it for you.

If you have employees who have worked with you for more than 3 years, you have to contribute a similar percentage to the employee accounts as well.

Please contact us if you need to establish a pension plan or need help with your existing plan. Contact us now.